In recent years, global e-commerce has boomed on the back of “low price + direct shipping.” A flood of small parcels poured into Europe and the U.S., pushing logistics and customs systems to their limits. Following the U.S. decision to close de minimis treatment, the EU has now taken similar action, announcing the removal of the €150 small parcel exemption, with a temporary solution expected as early as 2026.

What does this mean? Simply put, the era of EU de minimis is coming to an end. Even parcels worth €2, €5, or €10 may now face taxes, inspections, or handling fees. For sellers relying on low-cost, direct-shipped goods, this represents a structural shift. This article explains the new rules and how sellers can adapt.

Why does the EU end of de minimis rule? Structural pressure prompted policy intervention

For more than a decade, the 150 EUR threshold allowed small parcels to enter the EU without customs duties, although VAT remained payable. The mechanism simplified clearance and reduced administrative load. However, data published by the Council of the EU shows the framework can no longer accommodate the volume and risk profile of modern e-commerce. Key factors behind the policy shift include:

Overcapacity within customs systems

In 2024 alone, an estimated 4.6 billion low-value parcels arrived in the EU. Approximately 91 percent originated from Asia, creating a sustained strain that exceeded existing customs processing capabilities.

High rates of mis-declaration and fragmented shipments

Close to two-thirds of all small parcels are assessed as potentially undervalued or artificially split to remain under the threshold. Addressing these practices has become essential to safeguard revenue, prevent the circulation of unsafe goods, and ensure the integrity of the customs environment.

Competitive distortion

Traditional EU-based importers and retailers routinely bear customs duties and VAT, while low-priced direct-to-consumer shipments from outside the EU benefited from duty-free entry. Policymakers have underscored the need to restore a level playing field across the Single Market.

Environmental and safety considerations

Frequent micro-shipments elevate carbon emissions and introduce compliance inconsistencies. The reform aligns with the EU’s environmental objectives and broader market-surveillance measures.

What the EU’s new rules mean for small parcels?

On 13 November 2025, the EU Member States reached a political agreement to eliminate the customs duty threshold and introduce a modernized, fully digitized approach to small-parcel processing. So, how the upcoming rules will work in practice? It includes:

Removal of the duty-free threshold

All non-EU parcels will become subject to customs duties from the first euro. This marks the end of the regime commonly referred to as de minimis EU.

Expected handling fees

Initial analyses suggest a potential charge of around 2 EUR per parcel, with lower rates for operators using authorized warehouses or EU-based distribution centers. Such measures are intended to streamline processing and reduce administrative load.

Transitional solution until 2028

Given the urgency of rising parcel volumes, the EU will introduce a temporary mechanism in 2026 to begin charging duties and related fees on low-value goods. This interim arrangement will remain in place until the EU Customs Data Hub becomes fully operational in 2028, at which point automated assessment, standardized declarations, and end-to-end data visibility will take over.

Which sellers and products will feel the impact most?

The new rule is not aimed at sellers from any specific country. It applies to any business shipping goods directly from outside the EU to European consumers, as part of tighter EU regulation small parcel clearance. That said, certain product types and seller models face disproportionately higher pressure:

-

Low-priced consumer goods: Products, like accessories, small electronics, costume jewelry, low-cost apparel, and novelty items operate under thin margins. With added charges and stricter controls, profitability may be significantly reduced.

-

Marketplace and SME sellers: Large platforms may partially absorb the transition, but many small and mid-sized exporters rely heavily on direct shipping for competitiveness. Increased administrative requirements may prove challenging without operational adjustments.

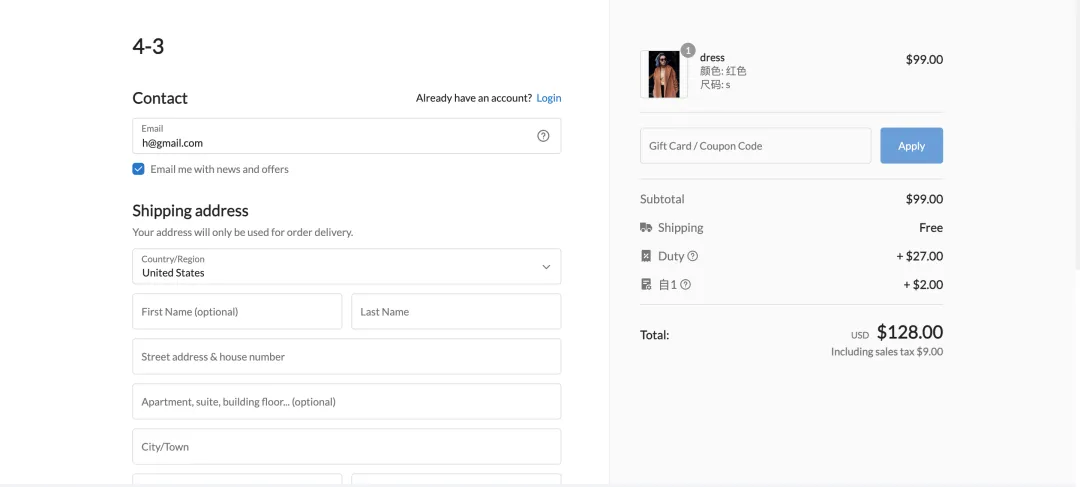

To understand the scale of the impact, a simple example is enough. Assume a cross-border seller offers a product priced at €5, with a unit cost of €1.2 and international shipping of €1.5.

| Item | Under the previous rules | Under the new rules |

| VAT | Around 20% (≈ €1) | Still payable at ≈ €1, with stricter reporting |

| Customs duties | None | Duties applied, plus an expected handling or processing fee (≈ €2) |

| Shipping | €1.50 | €1.5, plus additional compliance and declaration costs |

| Product cost | €1.20 | €1.20 |

| Total cost | ≈ €3.7 | €6 or more |

| Retail price | €5 | €5 |

| Result | ≈ €1.3 profit | At least €1 loss |

Operational risks to anticipate

Beyond increased duties, sellers may encounter:

-

Higher rejection or return rates due to incorrect declarations

-

Extended delivery timelines

-

Customer complaints arising from unexpected charges

-

Reduced competitiveness for low-value single-item orders

How cross-border sellers can respond to the EU policy shift?

As the EU de minimis threshold is phased out, business models built on cheap, single-item direct shipping will come under sustained pressure. Further, it forces a fundamental rethink of how cross-border e-commerce operates. Sellers that want to stay competitive will need to adjust their fulfillment, pricing, and channel strategies accordingly.

Shift from direct shipping to EU-based fulfillment

With new duties and handling fees applied at the parcel level, single-item direct shipping becomes significantly more expensive. One effective way to manage this pressure is to move toward EU-based warehousing combined with bulk imports.

Sellers can set up or lease EU-based warehouses and import high-repeat products in bulk to support local fulfillment. This reduces unit processing costs, eases customs friction, improves delivery speed, and strengthens inventory control. The model is particularly suitable for low-priced, fast-moving goods with multiple SKUs, where scale and efficiency matter most.

Build a branded website and expand across markets

Sellers that depend on a single marketplace or a single market are most exposed to regulatory and policy shifts. A branded website, whether as a DTC store or a print-on-demand store, allows merchants to increase order value through personalization and differentiated product presentation while strengthening customer loyalty.

High-conversion themes such as Reformia support flexible layouts, including grids, masonry displays, and mixed media sections. This allows sellers to design clear navigation, showcase multiple product categories, and create a more compelling shopping experience.

Beyond design, a website enables direct customer management, lowers dependence on platform commissions, and allows faster operational adjustments when policies change. For sellers that also use marketplaces or social media, it can work alongside TikTok, supporting a dual-channel strategy with greater control over orders, payments, logistics, and tax handling.

Besides, with multiple language and market setup, sellers can serve the UK, Japan, Korea, and other regions at the same time. When regulations change in one market, your operation can be adjusted quickly to reduce risk and improve long-term stability.

Offer product bundles and reduce reliance on low-priced items

With tighter rules squeezing margins on single, low-cost products, sellers revisit product strategy under the de minimis exemption EU.

-

Bundle sales: Combine items into sets or packages to increase order value. Higher-margin bundles help cover new duties, handling fees, and compliance costs.

-

Product re-selection: Focus on repeat-purchase categories like beauty accessories, pet supplies, home décor, or unique design items. These boost repeat orders and strengthen brand identity.

-

Pricing strategy: Adjust prices based on cost analysis and clearly show taxes and fees to customers. Promotions, bundles, and installment options can reduce sensitivity to price changes. Platforms like Shoplazza allow accurate multi-country tax settings and integrate tools like Avalara to automate tax calculations, keeping pricing transparent and compliant.

Strengthen compliance and customs reporting

As enforcement tightens, compliance will become a core operational requirement rather than a back-office task.

-

Accurate declarations: Each shipment must include correct HS codes, origin information, declared value, and valid EORI numbers.

-

System readiness: VAT, IOSS, and logistics systems should be updated to ensure data consistency and avoid clearance delays, seizures, or returns.

-

Professional support: Working with experienced 3PL providers and compliance specialists can help sellers navigate regulatory complexity, reduce operational risk, and control hidden costs linked to non-compliance.

Is it time to adapt your business to the EU market?

Now, sellers face a clear window to prepare. The temporary solution will start in 2026, followed by a fully digital customs system in 2028, giving forward-thinking sellers time to adjust.

Market and regulatory pressures are rising simultaneously. As the duty-free era ends, consumer expectations, platform rules, and customs oversight will tighten, eroding the advantage of low-cost direct shipping.

Competition is also shifting. Sellers investing in compliance, EU-based fulfillment, branded websites, higher-value products, and multi-market strategies are positioned to lead the market. Those relying solely on low-cost, high-volume, thin-margin models risk falling behind.

For serious cross-border businesses aiming for long-term growth, now is the critical moment to rebuild supply chains, pricing strategies, brand presence, and sales channels—early action lays the foundation for future stability and profitability.

Seize future profit

The EU’s removal of the small parcel exemption presents both a challenge and an opportunity for cross-border sellers. By optimizing supply chains, increasing product value, building branded websites, and ensuring compliance, sellers can protect profits and maintain competitiveness under the new rules. Shoplazza continues to monitor policy changes and offer end-to-end ecommerce solution, helping sellers turn uncertainty into steady growth and transform challenges into new business opportunities.

Frequently asked questions about EU de minimis

Q1: Is de minimis still in effect for the EU?

The traditional EU de minimis threshold, which allowed low-value parcels under €150 to enter duty-free, is being phased out. A temporary solution is expected to start in 2026, and by 2028, the EU’s unified digital customs system will fully remove the exemption. After that, all parcels from non-EU countries will be subject to duties and taxes from the first euro.

Q2: Is EU de minimis ending for all countries?

Yes. The removal of the EU de minimis treatment applies to all sellers shipping directly from outside the EU, regardless of their country. While it affects all cross-border sellers, those sending a high volume of low-value parcels are expected to feel the impact most.

Q3: How can non-EU sellers respond to the new rule and manage added costs?

Sellers can reduce risk by using EU-based or regional warehouses, shipping in bulk, and centralizing distribution to optimize inventory and logistics. Other strategies include increasing product value, bundling items, focusing on higher-ticket products, and leveraging branded websites to create added value and multi-market reach, helping to spread risk and maintain profitability.