AI Made Acquisition Faster — So Why Does Growth Feel Less Stable?

Over the past two years, AI has dramatically improved how ecommerce brands acquire traffic. Creative production is faster. Targeting is more precise. Testing cycles are shorter. With generative tools, copy, visuals, and video variations can be produced and iterated at scale. On performance dashboards, many metrics look stronger than ever.Yet growth feels less stable.Pause paid campaigns, and traffic drops immediately. Reduce budgets, and revenue follows. Even when a campaign performs well, it is difficult to tell whether that performance will persist. Each new round of spending feels like starting over. Efficiency has improved, but predictability hasn’t.This tension is not primarily operational. It is structural.AI has not simply made acquisition more efficient. It has exposed a deeper difference between two fundamentally different economic models: one built on recurring competition for attention, and one built on accumulating relationships over time. As we explored in our analysis of how AI is reshaping brand operations, structural shifts rarely eliminate effort—they relocate where advantage is created. Understanding that difference is essential to explaining why AI-driven efficiency has not translated into stability.

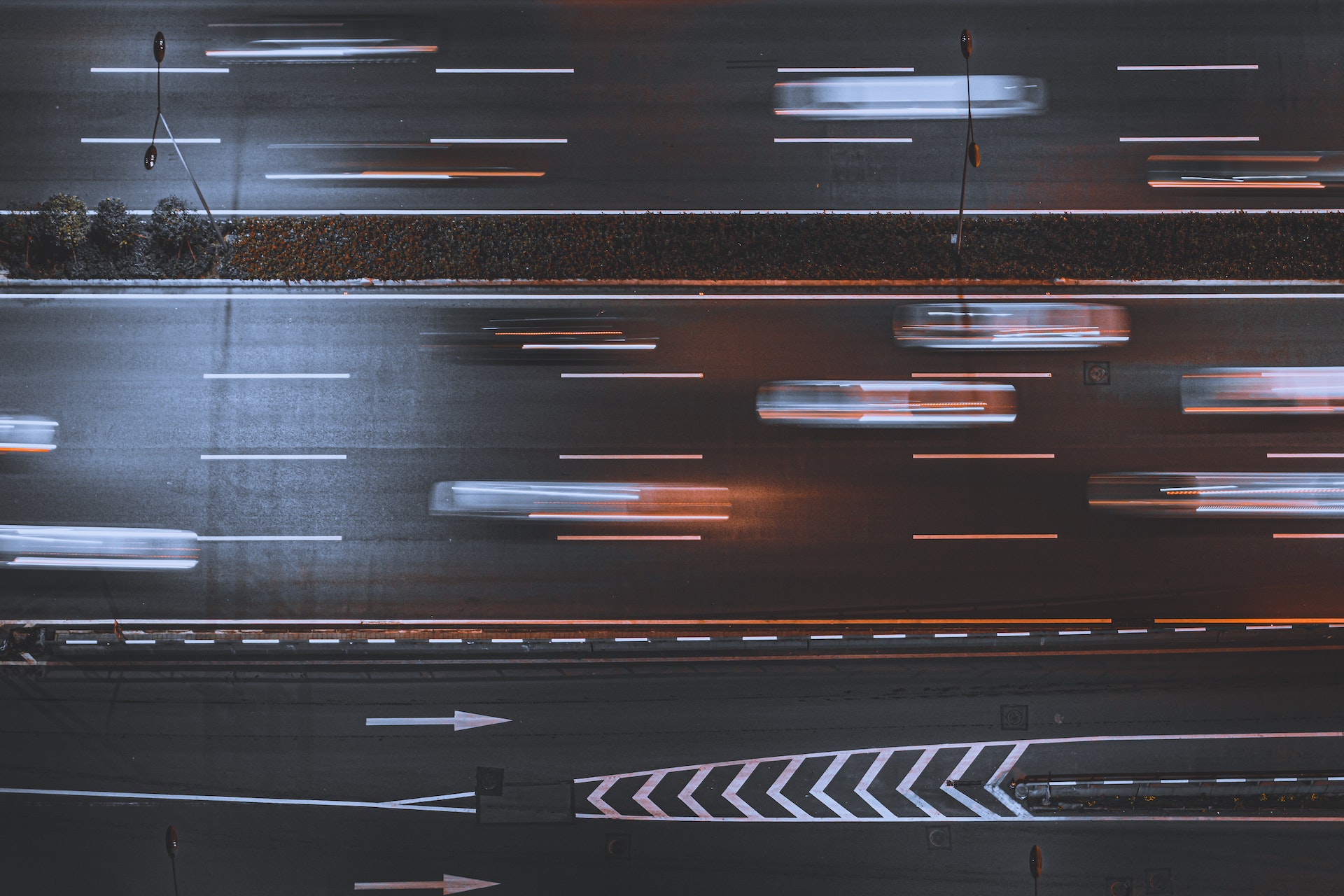

How AI Is Reshaping the Economics of Traffic

AI’s most visible impact on traffic lies on the production side. What once required coordinated teams—copywriters, designers, editors, media buyers—can now be generated, tested, and iterated by far fewer people in far less time. Creative variations multiply quickly. Targeting adjustments happen in near real time. Entry barriers to paid acquisition have fallen.But cheaper production does not mean cheaper attention.As content supply expands, competition intensifies. More brands can afford to test more angles, launch more campaigns, and enter the same auctions. The result is not a calmer marketplace, but a denser one. AI lowers the cost of participation, which increases the number of participants. Attention, however, remains finite.In this environment, scarcity shifts. It no longer sits in the ability to produce assets. It sits in the ability to capture and hold attention long enough to matter.Precision targeting further complicates the picture. AI-driven systems can identify relevant audiences faster and optimize bids more efficiently. Campaigns become sharper, waste decreases, and short-term performance improves. Yet this precision also standardizes capability. When many brands operate with similar optimization tools, differentiation through targeting alone becomes difficult. Each impression still requires renewed competition. Each click is still rented.This is why efficiency gains do not automatically translate into durability. AI can accelerate how quickly traffic arrives, but it does not change the underlying economics of how traffic behaves. Paid reach remains contingent on ongoing spend. Algorithmic visibility remains contingent on ongoing relevance signals. When the inputs slow, the outputs fade.The economic model of traffic, in other words, has become faster—but not fundamentally different. It is still a pay-to-renew system. AI reduces friction within that system, yet it does not convert traffic into something that compounds on its own.Understanding this distinction is critical. AI has improved the mechanics of acquisition, but it has not altered its dependency structure. Traffic can be optimized, scaled, and refined. It cannot, by itself, accumulate.The stability many brands seek will not emerge from acquisition efficiency alone. It depends on whether the traffic entering the system becomes part of something that learns—or remains a series of isolated transactions.

The Real Inflection Point: Data Ownership and Continuous Learning

If AI has made traffic faster but not more durable, the real inflection point lies elsewhere: in who controls the data that allows systems to learn over time.AI is often described as a productivity tool. In practice, its deeper value is not in execution speed but in pattern recognition. It improves when it can observe behavior repeatedly, detect signals across interactions, and refine its predictions based on historical feedback. In other words, AI creates leverage when it operates inside a system that accumulates memory.This is where structural differences begin to matter.In marketplace-centric or platform-bound environments, AI can optimize the current transaction. It can improve listings, adjust bids, refine keywords, and personalize on-site elements within the boundaries of the platform. These improvements can meaningfully increase short-term performance. But much of the behavioral data—how users browse, compare, hesitate, return, or switch—remains embedded within the platform’s ecosystem. Optimization occurs cycle by cycle.In an owned infrastructure environment, the logic changes. When customer interactions occur inside systems a brand controls—its storefront, checkout flow, communication channels, loyalty mechanisms—the behavioral data generated across visits does not disappear after conversion. It accumulates. The business can observe not just what converted, but how and why. Over time, that dataset becomes increasingly valuable, not merely for reporting, but for improving future decisions.This is the difference between optimization and learning.Optimization improves a single cycle. Learning compounds across cycles.AI amplifies whichever structure it operates within. If the underlying system resets every time a campaign ends, AI can only make each round more efficient. If the system retains and reuses behavioral data across multiple touchpoints, AI can gradually reduce uncertainty. It begins to anticipate rather than react.The economic implications are significant. When data compounds, acquisition decisions become more informed. Customer lifetime value becomes clearer. Retargeting becomes more precise. Product positioning becomes more grounded in observed behavior rather than assumption. Efficiency starts to translate into predictability.When data does not compound, each campaign remains a fresh negotiation with the market.This is why the debate is not ultimately about traffic channels or tool selection. It is about structure. AI does not automatically create durable advantage. It magnifies the architecture in which it operates. Where data can be continuously captured, interpreted, and reused, AI becomes an asset multiplier. Where interactions remain fragmented, AI remains an execution accelerator.The dividing line in the AI era is therefore not adoption, but accumulation.

Why AI Magnifies the Value of First-Party Data

If the real divide lies in whether systems learn, then the quality and ownership of data become central.First-party data is often reduced to email lists or purchase records. In reality, it is much broader. It includes how users arrive, what they click, how long they hesitate, which incentives influence them, what brings them back, and what pushes them away. It includes the structure of the interaction itself—the layout of pages, the sequencing of messages, the friction points in checkout. Whoever controls these elements controls the conditions under which data is generated.AI relies on continuity. It improves when it can observe the same audience across multiple interactions, not just within a single campaign window. When behavior can be tracked across sessions, purchases, and lifecycle stages, patterns begin to emerge. Those patterns reduce guesswork. Over time, efficiency starts to translate into judgment.Without continuity, each campaign remains self-contained. Even if performance improves marginally, the learning does not compound. Every new round of spend becomes another experiment conducted in partial isolation. The business may move faster, but it does not necessarily become wiser.This is why AI quietly increases the value of first-party data. It transforms data from a reporting tool into a strategic asset. The difference does not show up in a single dashboard snapshot. It shows up over time, as volatility decreases and decision confidence rises.Where learning compounds, risk gradually becomes more predictable. Where data remains fragmented, growth remains sensitive to external fluctuations.

What This Means for Ecommerce Brands at Different Stages

For early-stage brands, the AI era does not necessarily demand immediate scale. It demands clarity. When traffic becomes easier to generate, the more important question becomes which traffic is worth retaining. Not every click deserves long-term investment. The brands that establish mechanisms for identifying and nurturing high-intent or high-lifetime-value users early are better positioned to build stability, even with limited budgets.For scaling brands, the risk structure shifts. Rising acquisition costs are visible and measurable, but deeper uncertainty often comes from dependence on recurring competition. If each growth cycle requires re-winning attention from scratch, scale amplifies exposure to volatility. Larger budgets may drive larger revenue swings. Without a learning system that compounds insight over time, growth can become more fragile as it expands.In both cases, AI does not remove uncertainty on its own. It changes the terms under which uncertainty can be managed. Brands that treat AI as a faster acquisition engine will experience faster cycles. Brands that embed AI inside systems that accumulate and interpret first-party data will experience gradual stabilization.The difference emerges slowly, then decisively.

Where AI Actually Creates Long-Term Advantage

AI does not make traffic irrelevant. It makes structure decisive.Traffic remains essential. Discovery remains competitive. Paid channels and algorithms will continue to shape visibility. But in the AI era, acquisition is less likely to be a durable moat. It is a gateway.Long-term advantage emerges when acquisition feeds a system that learns. When each interaction enriches a dataset the brand controls, future decisions become less speculative. Messaging becomes more aligned. Retention strategies become more precise. Resource allocation becomes more informed.Over time, efficiency transforms into insight. Insight transforms into predictability. Predictability transforms into resilience.This is the shift AI is quietly reinforcing. It does not eliminate effort. It changes where effort produces lasting returns.

Conclusion

In the AI Era, the Real Investment Isn’t Traffic — It’s Learning

AI has made traffic acquisition faster, more precise, and more scalable. But speed and precision alone do not guarantee stability.The structural difference lies in whether traffic remains a recurring expense or becomes the entry point into a compounding system. When interactions are captured, interpreted, and reused, AI strengthens decision-making across cycles. When they are not, AI simply accelerates each round of competition.The real divide in the AI era is not who adopts new tools first.It is who operates in an environment where data accumulates and learning compounds.Traffic drives growth. Learning sustains it.

FAQ

Does this mean paid traffic is becoming less important?

No. Paid traffic remains a primary driver of discovery and scale. AI improves how efficiently traffic can be acquired. The question is whether that traffic feeds a system that compounds insight over time or remains dependent on continuous renewal.

Is marketplace selling structurally disadvantaged in the AI era?

Not necessarily. Marketplaces offer scale and built-in demand. However, in environments where customer-level data is limited, AI’s impact may focus more on optimizing current transactions than on building long-term learning loops.

What qualifies as first-party data in this context?

First-party data includes behavioral signals generated within systems a brand controls—such as browsing patterns, purchase history, engagement responses, and interaction pathways. Its value lies not only in collection, but in continuity and reuse.

Can AI compensate for weak data ownership?

AI can improve execution efficiency even with limited data control. However, without consistent access to reusable behavioral data, its ability to compound insight over time remains constrained.

For smaller brands, is it too early to prioritize customer data systems?

On the contrary, earlier integration often creates stronger foundations. AI has lowered the operational cost of managing customer relationships, making it more feasible for smaller teams to build learning systems from the beginning.